CorrectPay is a modern payment management solution designed to streamline financial transactions and enhance payment processes for users and businesses alike. With its user-friendly interface and innovative features, CorrectPay simplifies the handling of various payment needs, ensuring a seamless and efficient experience.

Features of CorrectPay

- Multi-Payment Support: Accepts a variety of payment methods, including credit/debit cards, bank transfers, and digital wallets.

- Secure Transactions: Employs advanced encryption and security protocols to protect sensitive financial information.

- Real-Time Monitoring: Provides real-time updates on transaction statuses and account activity.

- Automated Reconciliation: Facilitates automated reconciliation of payments, reducing manual errors and saving time.

- Customizable Invoicing: Allows for customizable invoice templates and automated billing processes.

- Integration Capabilities: Seamlessly integrates with popular accounting and ERP systems for streamlined financial management.

Pros and Cons of CorrectPay

Pros:

- Ease of Use: Intuitive interface makes it simple for users to navigate and manage payments.

- Enhanced Security: Strong security measures help safeguard against fraud and unauthorized access.

- Time-Saving Features: Automated reconciliation and invoicing reduce administrative workload.

- Versatile Payment Options: Supports a wide range of payment methods, accommodating various user preferences.

- Real-Time Updates: Keeps users informed with immediate updates on transactions and account changes.

Cons:

- Cost: May involve transaction fees or subscription costs that could be a consideration for small businesses.

- Learning Curve: Some users might require time to fully understand and utilize all features.

- Integration Issues: Potential compatibility issues with certain legacy systems or software.

Functions of CorrectPay

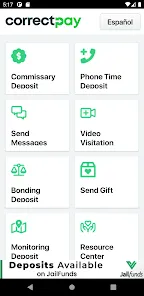

- Payment Processing: Facilitates secure and efficient processing of payments, including credit cards and digital wallets.

- Invoicing and Billing: Enables users to create, send, and track invoices, automating the billing cycle.

- Account Management: Provides tools for managing and monitoring account activity, including transaction history and balances.

- Financial Reporting: Offers detailed financial reports and analytics to help users understand their payment patterns and financial health.

- Customer Support: Includes support features for resolving payment-related queries and issues.

How to Use CorrectPay

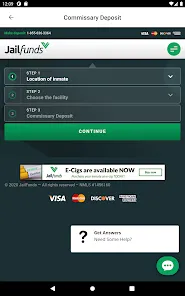

- Download and Install: Start by downloading the CorrectPay app from your device’s app store and install it.

- Create an Account: Open the app and follow the prompts to create an account by providing necessary personal or business details.

- Set Up Payment Methods: Link your preferred payment methods, such as credit/debit cards or bank accounts, to the app.

- Configure Settings: Customize your invoicing preferences, security settings, and notification preferences according to your needs.

- Start Processing Payments: Use the app to process payments, create invoices, and monitor transactions. You can also use the app’s features to automate billing and reconciliation tasks.

- Monitor and Review: Regularly check the app for real-time updates on transactions, account status, and financial reports.

CorrectPay provides a comprehensive solution for managing payments efficiently, combining security, versatility, and user-friendly features to enhance financial transactions for both individuals and businesses.

0

0