CARD.com is a financial technology app designed to provide users with a convenient, secure way to manage their money. It offers a range of features including customized prepaid cards, direct deposit options, and real-time transaction alerts. The app caters to individuals seeking to streamline their financial activities while maintaining a high level of control over their spending.

Features of CARD.com Mobile

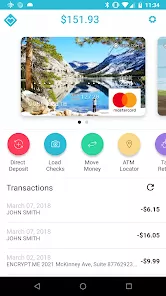

- Customizable Prepaid Cards: Users can choose from a wide variety of card designs or upload their own images to personalize their prepaid cards.

- Direct Deposit: The app allows users to set up direct deposit for their paychecks or government benefits, providing quicker access to funds.

- Real-Time Alerts: Users receive notifications for every transaction, which helps in monitoring and managing spending.

- Budgeting Tools: The app includes budgeting features to help users track their expenses and stay within their financial goals.

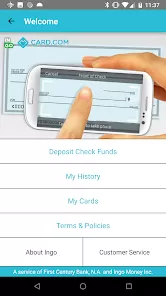

- Mobile Check Deposit: Users can deposit checks directly into their CARD.com account using their smartphone's camera.

- Easy Transfers: The app supports easy transfers between CARD.com accounts and external bank accounts.

Pros and Cons of CARD.com Mobile

Pros:

- Customization: The ability to design your own card or choose from a variety of designs adds a personal touch.

- Convenience: Direct deposit and mobile check deposit features make it easier to manage finances without frequent trips to the bank.

- Real-Time Monitoring: Instant notifications for transactions help users stay informed about their spending.

- Budgeting Support: Integrated budgeting tools assist in financial planning and management.

- User-Friendly Interface: The app’s design is intuitive and easy to navigate, making it accessible for all users.

Cons:

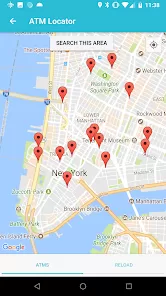

- Fees: Some features, such as ATM withdrawals and card replacements, may incur fees.

- Limited Banking Services: CARD.com offers prepaid card services but lacks some traditional banking features like loans and savings accounts.

- ATM Network Limitations: Access to free ATM withdrawals may be limited depending on the card type and user’s location.

- Customer Service Issues: Some users have reported challenges with customer service responsiveness and resolution times.

Functions of CARD.com Mobile

- Account Management: Users can view their account balance, track spending, and manage transactions all from within the app.

- Card Management: The app allows users to activate, deactivate, or replace their prepaid cards as needed.

- Transaction History: Detailed records of all transactions help users keep track of their spending patterns.

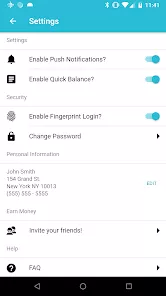

- Security Features: CARD.com includes security measures such as the ability to lock or unlock the card if it is lost or stolen.

- Rewards and Offers: The app may provide access to special offers and discounts at various retailers, enhancing the value of the card.

How to Use CARD.com Mobile

- Download and Install: Begin by downloading the CARD.com mobile app from the App Store or Google Play Store and install it on your smartphone.

- Sign Up: Open the app and follow the prompts to create a new account. You’ll need to provide personal information such as your name, address, and Social Security number.

- Customize Your Card: Choose a card design or upload a personal image to customize your prepaid card.

- Set Up Direct Deposit: Link your employer or benefits provider to your CARD.com account to enable direct deposit.

- Manage Your Finances: Use the app to track spending, set budgets, and deposit checks using your smartphone’s camera.

- Monitor Transactions: Enable real-time alerts to stay updated on all card activity and review your transaction history regularly.

- Use the Card: Spend using your CARD.com prepaid card at participating retailers, online, or withdraw cash from ATMs (keeping in mind any associated fees).

CARD.com Mobile aims to simplify financial management with its user-friendly app and versatile features, making it a practical choice for those seeking a prepaid card solution.

0

0